A smooth real estate transaction requires an easy and efficient property hunt. Being an expat, you might want to know how and where to find your new home, whether you should invest in a high-rise condo, a quiet apartment, or a house with a garden and pool. Below you will find all the answers to your questions on property transactions in the Philippines for foreigner, with a focus on Metro Manila – our area of expertise.

PRE-PURCHASE

Can a Foreigner Own Property in the Philippines

The answer is yes, foreigners may own real estate property in the Philippines, but they are not allowed to buy and own land. Foreign ownership of property in our country is not absolute and subject to restrictions.

The Condominium Act of the Philippines (RA 4726) expressly allows foreigners to acquire condominium units and shares in condominium corporations up to 40% of the total and outstanding capital stock of a Filipino-owned or controlled condominium corporation.

Foreign nationals, expats, or corporations may completely own a condominium or townhouse in the Philippines. To take ownership of private land, residential house and lots, and commercial building and lots, they may set up a domestic corporation in the Philippines. This means that the corporation owning the land has less than or up to 40% foreign equity and is formed by 5-15 natural persons of legal age as incorporators, the majority of which must be Philippine residents.

However, there are very few single-detached homes or townhouses in the Philippines with condominium titles. Most condominiums are high-rise buildings.

Investment Opportunities in the Philippines

The Philippines is one of the most dynamic economies in the East Asia and the Pacific region. With increasing urbanization, a growing middle-income class, and a large and young population, the Philippines’ economic dynamism is rooted in strong consumer demand supported by a vibrant labor market and robust remittances. Business activities are buoyant with notable performance in the services sector including the business process outsourcing, real estate, and finance and insurance industries.

In a press briefing, World Bank Group acting chief economist for the East Asia and Pacific region Andrew D. Mason noted that “the Philippines over the last decade has had outstanding growth performance—it’s above average for developing East Asia.”

The top places to buy a property in the Philippines as a foreigner are:

1. Bonifacio Global City

Often called “BGC” for short, the neighborhood is a master-planned financial center built and managed by the country’s biggest developers. BGC is basically the antithesis of Manila and Makati – it’s a business district that doesn’t attract heavy traffic due to its well-planned streets and blocks that provide access to the efficient circulation, pedestrian-friendly streets, an efficient and comfortable public transport system, and above all that is a complete environment where residential properties are just a stone throw away from businesses, offices, schools, and commercial centers.

WHY BGC:

- Bonifacio Global City is a prime business district filled with other offices and commercial establishments.

- Home to countless opportunities, such as startups with ambition, people with buying power, and residential units that are perfect for families.

- Accessible location.

2. Makati

Living in Makati has tons of benefits. From the well-managed streets to the easily accessible transportation, as well as the abundance of malls and restaurants surrounding the city. Businesses and industries blossom every day in this concrete jungle.

The appeal of Makati’s Central Business District needs no explanation as it is unrivaled in the country. It is home to the headquarters of 40 percent of the top 1,000 multinational corporations and prestigious local companies thus making it one of Asia’s important financial, commercial, and economic hubs. Makati is also close to other top cities such as Taguig and Pasay City, making this the residential and lifestyle hotspot that it is today.

WHY MAKATI:

- It’s dubbed as the “Financial Capital of the Philippines,” and the “Wall Street” of Metro Manila.

- It’s home to many reputable local and international companies.

- It boasts numerous entertainment and residential centers.

Do You Need an Expert – Agent or Lawyer?

Buying a condominium in the Philippines is typically done through an agent. Generally, the agent would draft a standard agreement encompassing all the details of the purchase to be signed by the seller and the buyer. Purchasing a condominium can also be done directly, without an agent. However, we recommend that you use an agent as this person not only understands the local market but will also represent you with your best interests at heart.

You must familiarize yourself with the legal process before buying a property in the Philippines as a foreigner. Furthermore, while a lawyer is not legally required, it is advisable to consult with one to assist you with the process of complex purchases. Legal jargon and legislation can be complicated to decipher, so it is desirable to have an expert to help you. Also, to ensure the transaction runs smoothly, we strongly recommend that you choose a recognized developer in the market who can offer you legal consultation as part of their service.

Can I Get a Visa for my Property Purchase?

The Philippines government has a provision for a Special Resident Retiree’s Visa (SRRV) that entitles the holder to reside during his lifetime in the Philippines, permitting multiple entry privileges. Any foreigner, who is at least thirty-five (35) years of age, is eligible to apply for an SRRV. The SRRV program of the Philippine Retirement Authority (PRA) requires the foreign national to have a certain amount of deposit in any PRA-accredited bank in the Philippines.

This deposit may be converted into an active investment. The total amount of investment must be at least US$50,000 for conversion to be allowed. You can choose to invest your deposit through the following means:

- Purchase, acquisition, and ownership of a condominium unit;

- Long-term lease of house and lot, condominium, or townhouse for a period not shorter than twenty (20) years; or

- Purchase, acquisition, and ownership of golf or country club shares.

What Expenses are Involved?

When buying a property in the Philippines, a down payment of 10% to 30% is usually required. Ownership of condominium units is evidenced by the Condominium Certificate of Title (CCT), but the transfer of title is usually not executed until the property is fully paid for.

In addition to the cost of the property, there are some additional costs involved that must be paid by the seller and the buyer.

Costs incurred by the SELLER:

- Capital Gains Tax

The Capital Gains Tax is 6% of the Selling Price or Zonal Value or Fair Market Value, whichever is higher, on the sale of a property not categorized as an ordinary asset.

- Value Added Tax (if applicable)

The Value-Added Tax is 12%, imposed on sales of those who are engaged in the business of selling, developing, leasing, or sub-leasing real property.

- Real estate agent’s fee

The professional fee is paid to the Real estate agent.

Costs incurred by the BUYER:

- Documentary Stamps Tax

The Documentary Stamps Tax (DST) is a type of tax levied on documents, instruments, loan agreements, and papers evidencing the acceptance, assignment, sale, or transfer of an obligation, right, or property. The tax rate is 1.5 percent of the selling price or zonal value or fair market value, whichever is higher.

- Notary fee

To notarize the Deed of Absolute Sale requires a fee of about 0.1 to 0.15 percent of the property’s selling price. This fee must be paid by the buyer.

- Local Transfer Tax

This is a tax imposed on any mode of transferring the ownership of a property, either through sale, donation, or barter. The transfer tax rate varies from 0.5 percent to 0.75 percent of the zonal value or selling price of the property, whichever is higher.

- Registration fee

This fee is paid for the registration of a Deed of Absolute Sale of a property. It is paid to the local Registry of Deeds or Land Registration Authority where the property is located.

Here is a summary of all the additional costs incurred during the sale of a property:

| TRANSACTION COSTS | ||

| Who Pays? | ||

| Notarial Fee | 1% – 2% | buyer |

| Local Transfer Tax | 0.50% – 0.75% | buyer |

| Registration Fee | 1% | buyer |

| Documentary Stamp Tax | 1.50% | buyer |

| Capital Gains Tax | 6.00% | seller |

| Value Added Tax | 12.00% | seller |

| Real Estate Agent´s Fee | 3.00% – 6.00% | seller |

| Costs paid by the Buyer | 4% – 6% | |

| Costs paid by the Seller | 6.00% – 17.50% | |

| ROUNDTRIP TRANSACTION COSTS | 10% – 23% | |

If you have further questions, please consult a Luxury Estate PH property expert.

PURCHASE

Steps for Purchasing Real Estate in the Philippines

The process of buying property in the Philippines can be a bit complicated and taxing, especially if you are not aware of all constraints involved. Hence, to simplify the process we have listed the step-by-step process:

- Owner and Buyer agree on the sale of a property. A Deed of Absolute Sale (DOAS) is created and notarized through a licensed lawyer.

- A Land Tax Declaration is secured from the Bureau of Internal Revenue (BIR) and submitted to the city or municipal Assessor´s office.

- The buyer pays real estate tax to the City Treasurer´s Office.

- The Assessor´s office assesses the market value of the property.

- Transfer taxes are paid by the buyer to the Assessor´s Office.

- Capital Gains Tax and Documentary Stamp Tax are paid to BIR by the seller of the property.

- The Registry of Deeds (RD) cancels the old title and issues a new one in the name of the buyer.

- The buyer, now the new owner, obtains a photocopy of the new title and requests for tax declaration from the Assessor´s office.

Do Banks Give Loans to Expats for Buying a Property?

Buying property in the Philippines is becoming easier as some banks now offer loans to foreigner for buying property. Naturally, one of the most important criteria that the banks require from applicants is a proven source of regular income.

However, the exact details of how easy it will be to get a home loan as an expat in the Philippines will depend on your visa type and financial circumstances. For example, BDO banks offer mortgages to expats who hold any one of a specific series of visas, including Quota or Preference Immigrant Visas, Special Resident Retiree Visas, or those with permanent residence status and working visas in some areas of the country.

To check your eligibility for a financial loan, we recommend meeting with a few banks to discuss your situation. You can also meet with a licensed broker or agent who is experienced in working with foreigners.

Which One Makes the Best Sense for Expats – Off-plan or Completed Projects?

One of the most common dilemmas for people while buying property is whether to buy a pre-selling property or a ready-for-occupancy property. Both these options have their own distinct advantages:

Advantages of Buying Pre-selling Property

Customizable property: You can buy the property before completion, giving you a lot more opportunities to customize the property. You can then consider how to decorate and select furniture and appliances to suit your tastes as well as your budgetary needs.

Low Cost: The earlier you buy pre-selling, the better price quote you will receive as Developers tend to offer promotional discounts at the beginning of a project. These savings can be substantial depending on how early you view the property.

Equity Growth: The best incentive is that you will be able to sell the project before it is completed and even potentially make a profit.

Advantages of Buying Ready-for-Occupancy Property

Immediate Returns: If you wish to make an immediate return on your investment, you should be able to rent out the property right away.

Moving In: The final product will be readily available for your inspection, as you don’t have to wait for construction completion. Therefore, this is beneficial if you are looking for a fast turnaround.

Easy Reselling: An established property in a popular location is always likely to grow in value, meaning should you wish to move on, you should be able to do so more quickly and with a positive return on the property sale.

PHILIPPINES AS AN INVESTMENT HOTSPOT FOR OVERSEAS BUYERS

The Philippines is one of the fastest-growing economies in Asia, and one of the English-speaking nations in the world, which is particularly encouraging to many foreign investors. Investing in Philippine real estate is projected to continuously soar in the upcoming years.

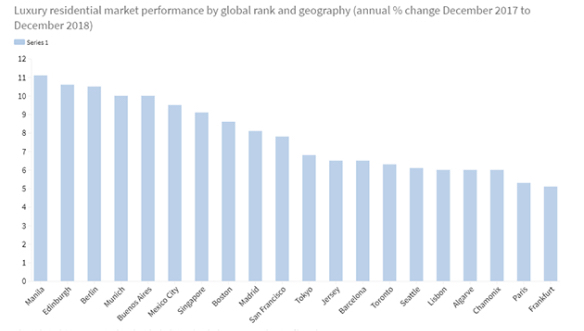

According to Knight Frank, a property consultancy agency in London, Manila is number one in market performance in the world of luxury residential property in 2018. In the twelve years since its inception, Knight Frank’s Prime International Residential Index (PIRI 100), is an index that monitors the movement of luxury prices across the globe’s top residential markets.

According to the study, Manila’s luxury home prices rose by 11 percent from December 2017 to December 2018.

POST PURCHASE

What If You Plan to Rent Out Your Property?

The Philippines is among the top 10 countries in the world where expatriates lead a comfortable life. The low cost of living, friendly locals, and comfortable climate make it a top choice for Expats to live and work.

Based on data from HSBC’s Expat Explorer survey, the Philippines ranked:

- 1st overall for expats to feel closer to their partners

- 5th for social life

- 8th for ease of integrating with the locals.

Most of these expats prefer living in Metro Manila – Taguig and Makati, because of its new and advanced development. Also, the occupancy rates for expats are high in the Philippines, ensuring that you get a good ROI on your investment.

Average rental prices in Metro Manila:

| LONG-TERM (> 1 year) in PHP/month | SHORT-TERM (< 1 year) in PHP/month |

| Apartments & condominiums 1 bedroom: 30,000 – 60,000 2 bedrooms: 45,000 – 120,000 3 bedrooms: 65,000 – 300,000 4 bedrooms: 85,000 – 400,000 | Hotels and serviced apartments 1 bedroom: 50,000 – 90,000 2 bedrooms: 90,000 – 140,000 3 bedrooms: 120,000 – 350,000 4 bedrooms: 180,000 – 350,000 |

| Single houses/villas 3-4 bedrooms, garden: 100,000+ 3-4 bedrooms, garden & pool: 140,000 | Apartments & condominiums 1 bedroom: 40,000-80,000 2 bedrooms: 60,000-120,000 3 bedrooms: 120,000-200,000 4 bedrooms: 160,000-250,000 |

| Townhouses 3-4 bedrooms: 60,000+ |

LUXURY ESTATE PH OFFERS A HASSLE-FREE PROPERTY INVESTMENT SERVICE.

Luxury Estate PH is dedicated to providing top-notch real estate services to affluent buyers and sellers of all nationalities. From the selection of the best luxury estates to completing your purchase or getting access to key market insights when selling a property in the Philippines, Luxury Estate PH partners with experienced luxury property specialists qualified to guide you as a foreigner through the process.